Breaking News

Main Menu

How Do I Delete A Deposit In Quickbooks For Mac

понедельник 12 ноября admin 89

Creating a bank deposit for your cash and check payments correctly is one of the important tasks necessary to properly track the balance of funds you have in your bank account. To practice making a deposit, open a sample data file: • On the Home page, click the Record Deposits icon. • Using the sample data for practice, the Payments to Deposit dialog box displays a listing of payments received that have not yet been recorded as a deposit into the bank account. When you are working in your data, if this message does not display, you do not have any payments that were recorded to the Undeposited Funds account.

May 1, 2013 - QuickBooks Tip: How to Edit a Payment that is already Deposited. Customers in QuickBooks Data File QuickBooks Tip – Clear “To be. Double-click the deposit you want to delete. Click Edit at the top. Hit Delete Payment on the drop-down. Let me know if you need additional help by leaving a comment below. Thank you for doing business with QuickBooks.

What is the best app for word documents on mac. • From the View Payment Method Type drop-down list, select Cash and Check. This step is optional, but it helps to group the payments by the type of deposit. • Click the Select All button to place a checkmark next to each of the amounts listed.

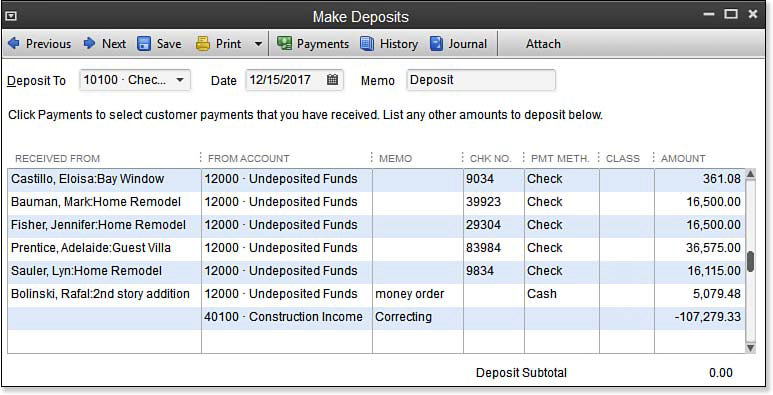

(See image below.) Your total might differ if you did not complete the exercise in the previous section. Place a checkmark next to each payment item that is included on your deposit ticket.

• When you click OK, QuickBooks adds the selected payments to the Make Deposits dialog box. • Confirm that the Deposit To account is correct, and select the Date your bank will credit your account with the funds. Entering details in the Memo field will display in reports. • From the Print drop-down list, select to print a deposit slip (preprinted forms are necessary) or print a deposit summary for your file, as shown here.

Q: What do I need to be able to use QuickBooks Desktop Payroll? A: You will need to have QuickBooks 2015 or newer.

The federal government requires every person or company paying wages to have an Employer Identification Number (EIN). Employers must include it on all federal forms and returns. You can apply for an EIN at the following IRS Web site: You'll also need Internet access to automatically download the latest payroll tax rates. Q: Does QuickBooks Desktop Payroll handle both hourly and salaried employees? QuickBooks Desktop payroll covers both hourly and salaried employees. Q: What about bonuses, commissions, and overtime?

A: QuickBooks Desktop Payroll handles all of these, plus many other wage types. Q: How do I pay my employees? A: Just enter your employees' hours, and QuickBooks Desktop Payroll will calculate paychecks, subtracting payroll taxes and deductions. Then print paychecks instantly, or use our convenient Direct Deposit. You can also pay groups of employees on different days. For example, you may pay salaried employees monthly, while paying hourly employees weekly. Q: Can I pay contractors and produce 1099s?

You can pay both regular employees and independent contractors with QuickBooks Desktop Payroll. Q: Can I pay employees using direct deposit? With Intuit's Direct Deposit, you can deposit pay into U.S. Bank accounts. You can always add or remove an employee, or edit their banking information as needed. You can also choose to pay some employees by direct deposit and others by check. Mac emulator for psp. You must send Direct Deposit transactions to us by 5:00 pm (Pacific Time) two business banking days before the paycheck date.