Breaking News

Main Menu

Best Alternative To Quickbooks For Mac

понедельник 05 ноября admin 88

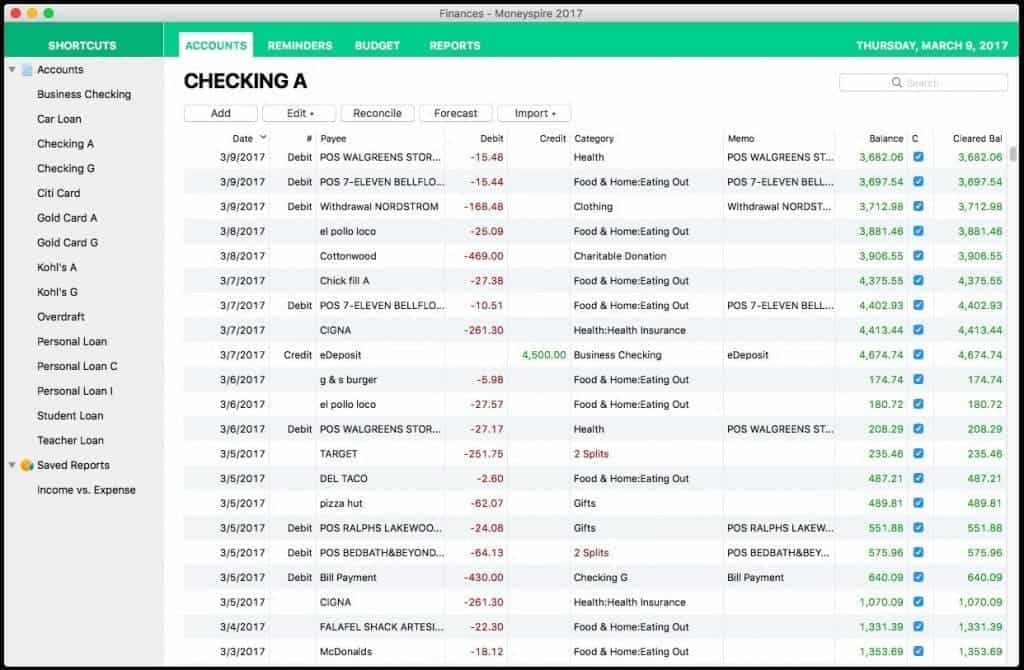

Moneyspire’s features make it one of the best Quicken alternatives for business users if you’re willing to pay for the privilege of using the app, but we found the desktop app—available on Windows and Mac —to be simple enough for non-prosumer users as well.

Youtube music converter for mac. Billie Anne Grigg has been a bookkeeper since before the turn of the century (yes, this one). She is a QuickBooks Online ProAdvisor, LivePlan Expert Advisor, FreshBooks Certified Beancounter, and a Mastery Level Certified Profit First Professional. She is also a guide for the Profit First Professionals organization.

Billie Anne started Pocket Protector Bookkeeping in 2012 to provide an excellent virtual bookkeeping and managerial accounting solution for small businesses that cannot yet justify employing a full-time, in-house bookkeeping staff. Advertiser Disclosure You’re likely well aware that QuickBooks is the reigning incumbent for accounting and bookkeeping software in the United States. There’s a reason that so many small businesses turn to for their business needs—it’s easy to use, inexpensive, and training resources for the software abound.

But if you’re looking for a QuickBooks alternative, whatever your reason, great options do exist. Although there’s plenty working in QuickBooks’s favor—industry dominance, ease of use, and a low price point, for instance—there are some QuickBooks alternatives for small businesses available you might want to consider when you’re thinking about your financials. We’ll examine all of the best QuickBooks alternatives (including some free QuickBooks alternatives), and compare what they have to offer so you can decide if they’re the right pick for your small business. But, if you’re in a hurry, here’s the short list. Best QuickBooks Alternatives • Sage • Xero • FreshBooks • YNAB • QuickBooks Self Employed Let’s explore each of these Quickbooks alternatives below. The 5 Best Alternatives to QuickBooks for Small Businesses As you’re looking at these QuickBooks alternatives, before you settle on an option, make sure your data isn’t “trapped” if you change your mind. You want to be able to easily move data in and out of solutions, especially if your needs change as your business grows.

This is, of course, why it’s best to investigate several options before making your final decision! You can usually (although not always) get an Excel or a CSV file of your data should you choose to switch software programs. Be sure to confirm that before signing up. This will save you from having to spend valuable hours re-entering data by hand. QuickBooks Alternative Option 1: Sage Sage is a full accounting package. It produces a balance sheet and allows for bank reconciliations. Starting at just $10 per month for Sage Accounting Start, it’s very competitively priced, too.

Need more features than those offered in the $10 per month version? You can choose Sage Accounting for $25 per month to unlock unlimited collaboration, quotes and estimates, vendor bill tracking, cash flow forecasts, and the option to choose either cash or accrual basis accounting. Like Intuit (the maker of QuickBooks), has a wide variety of options for helping you scale your business, including an accountant partner program and its own series of conferences to help you learn, collaborate, and grow. QuickBooks Alternative Option 2: Xero Like Sage One and QuickBooks, is also a full accounting package. This New Zealand-based company is the industry leader in New Zealand, Australia, and several European countries, too. Built “in the cloud, for the cloud,” Xero has avoided many of the perceived missteps its competitors have made when they transitioned to cloud-based accounting services. Xero touts itself as “beautiful accounting software,” and, really, it is.

Two of the things small business owners love most about this alternative to QuickBooks Online is the simplicity of its interface and its avoidance of. No debits or credits here—just easy-to-understand language that makes it simple to determine what to do with your transactions.

The reconcile-as-you-go feature is also a favorite of small business owners, though many accountants and bookkeepers prefer a separate reconciliation function. Xero has three pricing tiers. If you’re a super-small business, the Starter package at $9/month may work for you. However, most small businesses quickly outgrow this package and move up to the $30/month Standard package.

More complex businesses dealing with multiple currencies and larger payrolls need the Premium package, which starts at $70/month. QuickBooks Alternative Option 3: FreshBooks What started out as an invoicing- and time-tracking software has evolved into a powerhouse for the self-employed. Lets you invoice and collect payments from your clients, track your expenses, and collaborate with your subcontractors. It also works with a suite of external applications to help you build a truly customized solution for your business.